Gold Traders Get Little Rest From ‘Wild Day’ as Volatility Jumps August 15, 2019 – Posted in: Press – Tags: Bloomberg, Gold, Traders, Volatility

Gold Traders Get Little Rest From ‘Wild Day’ as Volatility Jumps

Published August 4th, 2019

Written By: Justina Vasquez and Joe Richter

Donald Trump and the Federal Reserve are messing with gold traders’ heads.

Bullion got whipsawed this week as comments from Federal Reserve Chairman Jerome Powell damped expectations for a lengthy easing cycle, while fresh U.S tariff threats a day later fueled global-growth concerns that renewed demand for the metal as a haven. Payrolls data Friday showing higher U.S. wages and slower job gains did little to add clarity.

“We had a wild day in the markets yesterday, perhaps apt considering that this is the start of August when crazy things usually happen,” Ed Meir, an analyst at INTL FCStone, said in a report Friday. “Market conditions remain unsettled.”

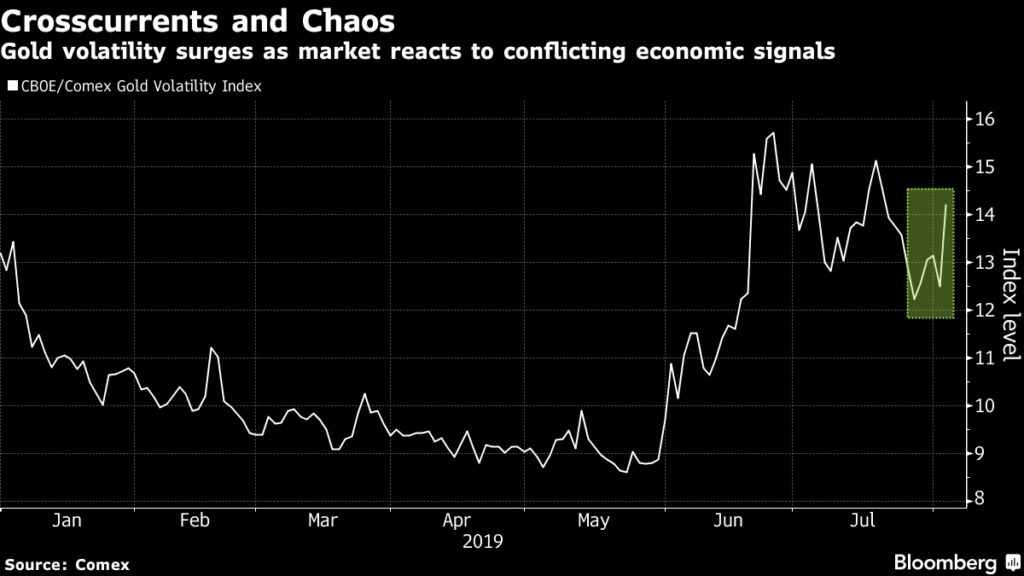

The CBOE/Comex Gold Volatility Index, a measure of price swings on gold futures, rose the most in six weeks on Friday. Spot gold slipped 0.3% to 1,440.83 an ounce in New York, while gold futures for December delivery settled 1.8% higher on the Comex.

A U.S. government report Friday showed average hourly earnings climbed 3.2% from a year earlier, better than forecast, while the three-month average increase in payrolls was the slowest in almost two years. That came a day after Trump said in a tweet he plans to impose a 10% tariff on $300 billion of Chinese imports beginning Sept. 1, and Beijing pledged to respond if he follows through.

“Basically, the U.S. payrolls number didn’t really matter at all today because Trump has unleashed the beast on China,” Naeem Aslam, chief market analyst at ThinkMarkets, said by email Friday.

Jewelry sellers are also noticing market fluctuations. Holders of gold watches, earrings and necklaces know their window for getting a good price can be narrow, and they’re quick to sell their treasures, said Tobina Kahn, president of House of Kahn Estate Jewelers in Chicago.

“Now there’s more of a decision because I think the average person who sells jewels is understanding of the markets — that the market can change with a tweet,” Kahn said in an interview Friday. “They decide very quickly that day only because they realize that it might not continue to go up. They know that there’s volatility.”