Gold’s Rally to Six-Year High Spurs People to Sell Their Old Tiffanys and Rolexes August 15, 2019 – Posted in: Press – Tags: Bloomberg, Gold, Rolex, Sell, Tiffany, Watches

Gold’s Rally to Six-Year High Spurs People to Sell Their Old Tiffanys and Rolexes

By: Justina Vasquez & Marvin G Perez

Published: June 25th, 2019

A Rolex Sky-Dweller Oyster 42 mm Everose gold wristwatch.

Photographer: Luke MacGregor/Bloomberg)

Fund managers aren’t the only ones feeling the tailwind from gold’s rally to a six-year high.

Empire Gold Buyers saw business activity climb to the highest since 2011, when the precious metal traded at a record, CEO Gene Furman said. At House of Kahn Estate Jewelers, trading of old jewelry is up by almost half since last week, when the Federal Reserve signaled its openness to cut interest rates, propelling bullion prices higher, the company’s president Tobina Kahn said.

Refiners and recyclers of the precious metal are riding the rally as investor interest returns to gold after years of languishing mostly below the $1,350 an ounce level. More than $4.6 billion was added to exchange-traded funds linked to the bullion this month, buoyed by a record daily inflow into SPDR Gold Shares, the largest in the commodity space.

“People are coming out of the trenches,” said Furman, the chief executive officer of New York-based refiner Empire Gold which buys old jewelry for recycling and refining. “Cartier, Rolexes, Tiffanys, Van Cleefs: we see an uptick in the luxury market because people need to raise money.”

Gold climbed for a sixth straight session to $1,427.18 an ounce in the spot market at 11:40 a.m. in New York. Prices rallied as the S&P 500 index headed for its longest losing streak in six weeks. Mounting speculation the Fed may cut U.S. borrowing costs this year made non-interest bearing bullion more competitive, helping sustain the metal’s rally to the highest since 2013.

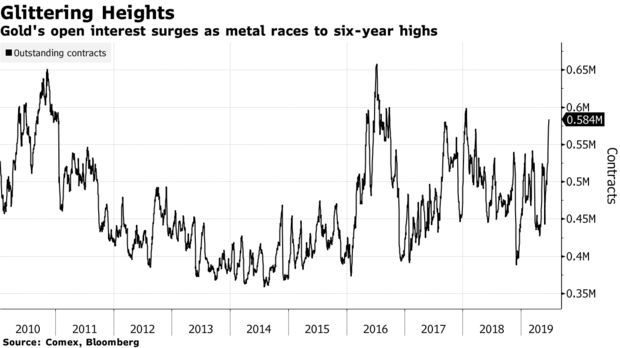

Speculators are also piling in. The aggregate open interest, a tally of outstanding gold futures contracts on Comex, is up 26% this month, the most in almost two years. ETF holders added almost 86 metric tons to their assets this year, according to data compiled by Bloomberg.

ETF holdings could climb by 800 tons this year through September, pushing prices above $1,600 an ounce, should developed markets continue to underperform, bolstering the case for owning bullion, Goldman Sachs Group Inc. analysts including Sabine Schels said in a note Tuesday.

“The tides are turning big time,” Kahn said in a telephone interview Monday. “As a gemologist, I’m a buyer, if I can see that gold is continuing to go up, I’m more confident about paying more for it than having it go down.”