Comparisons on Gold ETFs vs Owning Physical Gold from Tobina Kahn; House of Kahn Estate Jewelers August 12, 2016 – Posted in: Press – Tags: Coins, ETF, Gold, Investing, Stock Market

Recently, a number of new Gold ETFs have begun to gain popularity among those looking to capitalize on Gold’s price spike. These ETFs allow you to purchase shares that follow the price of Gold (to a point) but also allow the option to exchange those shares for physical Gold assets at any point in time, shipped to your door. This may sound like a good idea, in theory, but allow me to outline why owning physical Gold assets, with a collectible value, is a more worthwhile investment:

— Purchasing Gold opens up a variety of purchase options on Gold types: coins, bullion, bars, collectible, minted, etc.

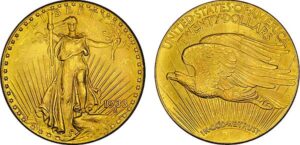

— In addition to this, the ability to purchase Gold assets that have further extrinsic value are involved. For example, you can begin to explore options that allow you purchase historically valuable, rare, and sought after Gold coins that offer an intrinsic value (based solely on the Gold weight) but even further extrinsic value based on collector demand, with the additional possibly of an increase in value into the future, as these historically significant and rare items become more in demand. You can always purchase newly minted coins from the US Mint or you can seek out coins that collectors will have a greater interest in the future, based on a number of other factors (no longer made or circulated, decrease in existing coins over time will spike demand over time, global collector community). I’ve attached photos of a coin I personally own as an investment/collector asset, which is has already increased in value a little over a year since I have purchased it: The 1907 High Relief $20 Wire Rim MS 67 Gold Coin (no longer in circulation)

— In the off chance, it would be extreme, but it is an executive order, the government could begin confiscate the population’s Gold if the price goes too high. In this rare case, it is more likely that they will seek out the more newly minted, currently circulated Gold types/assets, over the rare, collectible Gold asset types. The reasoning is that the collectible assets are lower in quantity and function mainly off of a collectible market. If the government confiscates them all, there is no longer a collectible market for these pieces, and in turn, no value (aside from its intrinsic value of Gold weight).

— ETFs themselves also come with a variety of limitations that hamper investing as opposed to purchasing physical Gold. Firstly, ETFs carry expense ratios. ETFs are also restricted by the market’s rules. In the case of the VanEck Merk Gold Trust and SPDR Gold Trust ETF, these are only traded on the US Stock Market (Dow Jones and Nasdaq), not globally. If you own physical Gold and a proper broker, you can connect with buyers for your Gold (even more-so for collectible Gold assets) that exist worldwide.

— To add on to the above point, trading on the market relies heavily on the average volume of an equity (in this case, an ETF). If trading volume is low or lower than average, you may find it harder to find a buyer or seller for one of these particular ETFs. This can, in turn, result in wider bid and sell spreads, which will result in difficultly entering a position on an ETF (or exiting). In scenarios which global news that can affect the price of Gold drastically (and subsequently, the price of a Gold ETF), you want high volume and liquidity so that you can enter and exit an ETF on your desired price immediately. This varies from ETF to ETF (for example, compare the relatively low, dry volume of VanEck’s ETF to SPDR’s Gold ETF). In addition to this point, you can only trade ETFs during market hours. If global news that negatively affects the price of Gold is published overnight, you will have to wait until market open to try and liquidate your position in a mad dash with millions of others simultaneously.

— Lastly, when you “invest” in a Gold ETF, you are not truly investing in Gold. The goal of exiting a position you have on a Gold ETF is that you hope to exit with a higher amount of cash (USD) than you invested initially. In the end, however, you are merely using the price movement of Gold to gain USD at the end of a position. True Gold investors tend to purchase tangible Gold assets as a hedge against inflation/deflation and a long-term weakening US Dollar. If you are trading a Gold ETF, you are only receiving more of the same currency (USD), that is still weak in the long-term. It is not truly a reasonable long-term play.

Gold broker fees will vary from broker to broker, however, I do believe that purchasing Gold via an established broker (and one that you can form a longterm bond with) is more beneficial, and quicker than the method that the VanEck Merk ETF offers (I noticed there is an application process, and VanEck must contact their Gold reserves once you request your conversion to start that process, it seems very bloated and cumbersome, time-consuming).

Again, with an ETF, you can only redeem your shares for common Gold type assets that are currently being minted in high volume, not collectible, out-of-mint Gold items. For example, anyone can go to the US Mint website right now and shop for a US American Eagle Gold coin, stamped with this years date, 2016. Currently, this has no extrinsic historic, collectible value, and its future value is uncertain (its a fairly new, minted product from this year).

It is due to these points that I believe owning physical Gold assets and jewels is the more sound choice when investing.